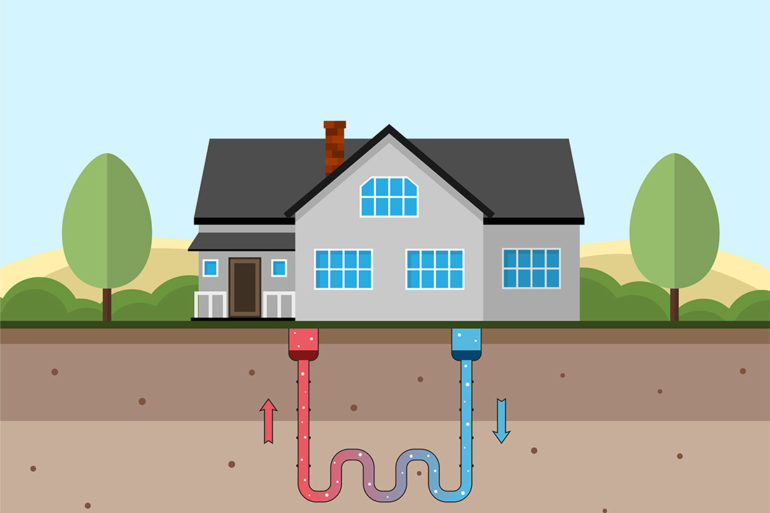

When you’re striving to build sustainable, tax credits become a crucial piece of the puzzle. So, for those firms incorporating geothermal heat pumps (GHPs) Technology in their planning, there was some good news recently: Maryland, New Hampshire, Rhode Island, Massachusetts, New York and Vermont have all designated the geothermal ground loop as a renewable thermal asset. And that qualifies the geothermal ground loop for Alternative Energy Credits (AEC) and Renewable Energy Credits (REC).

The winning argument pointed out that a geothermal ground loop is a type of renewable, one that doesn’t need the wind to blow or the sun to shine. The geothermal ground loop has a lifecycle of 50-100 years and works 24/7/366 (it doesn’t take Leap Day off).

With the recognition of the geothermal ground loop as a renewable asset in the states mentioned and the reestablishment of the investment Tax credit, using GHP technology is a smart financial choice.

John (Jack) P. DiEnna Jr is the Executive Director of the Geothermal National & International Initiative and can be reached at jdienna@geo-nii.org